Antwort Is a VIX of 20 high? Weitere Antworten – What if VIX is 20

:max_bytes(150000):strip_icc()/dotdash_Final_Determining_Market_Direction_With_VIX_Jun_2020-01-ac6dfb36d5d745b1a2999315d3e2008a.jpg)

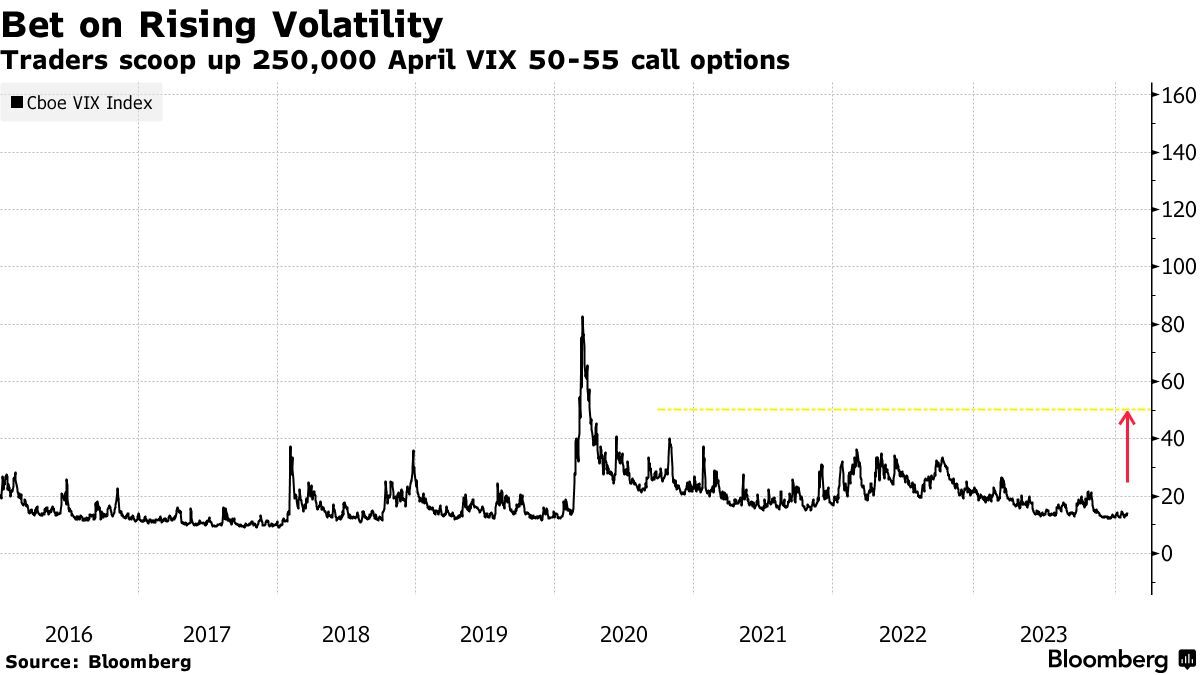

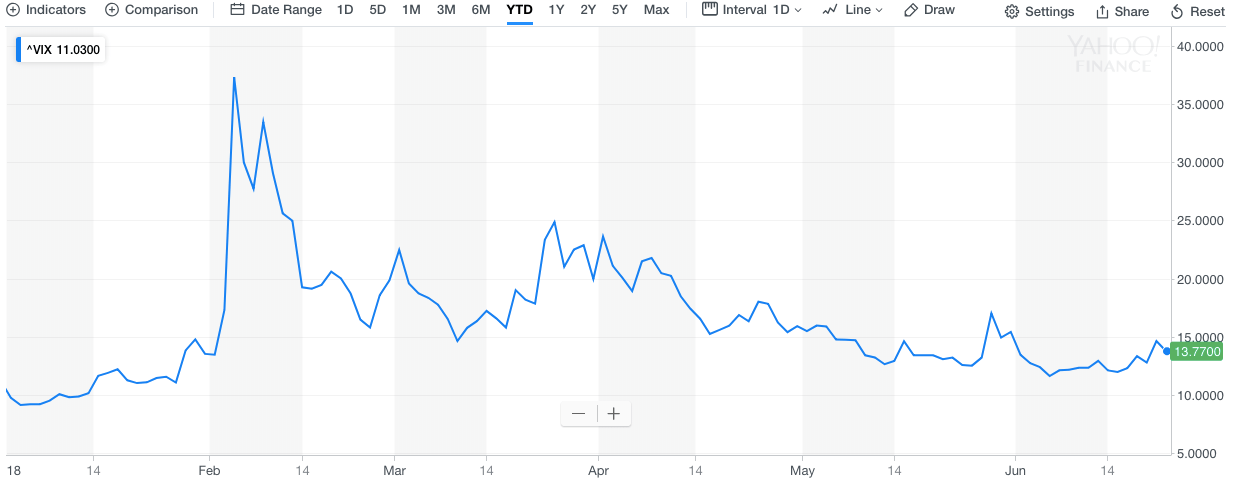

Historically, market corrections and bear markets become common when the VIX spikes to levels exceeding 25. Conversely, when the VIX hovers below 20, it tends to act as a tailwind to stocks, fostering sustainable market rallies.What do VIX readings mean In general, a VIX reading below 20 suggests a perceived low-risk environment, while a reading above 20 is indicative of a period of higher volatility. The VIX is commonly used to measure investor confidence in the market.In general, VIX values of greater than 30 are considered to signal heightened volatility from increased uncertainty, risk and investor fear. VIX values below 20 generally correspond to more stable, less stressful periods in the markets.

What does a 30 VIX mean : 25-30: This can indicate that there is a certain amount of market turbulence and volatility is increasing. 30 and over: This can indicate that the market is highly volatile and there may be some extreme swings soon.

Should you buy when VIX is high

"If the VIX is high, it's time to buy" tells us that market participants are too bearish and implied volatility has reached capacity. This means the market will likely turn bullish and implied volatility will likely move back toward the mean.

What does a VIX of 22 mean : A VIX of 22 translates to implied volatility of 22% on the SPX. This means that the index has a 66.7% probability (that being one standard deviation, statistically speaking) of trading within a range 22% higher than—or lower than—its current level within the next 12 months.

"If the VIX is high, it's time to buy" tells us that market participants are too bearish and implied volatility has reached capacity. This means the market will likely turn bullish and implied volatility will likely move back toward the mean.

According to the rule of 16, if the VIX is trading at 16, then the SPX is estimated to see average daily moves up or down of 1% (because 16/16 = 1). If the VIX is at 24, the daily moves might be around 1.5%, and at 32, the rule of 16 says the SPX might see 2% daily moves.

What does VIX above 15 mean

Suppose, VIX value is 15. It means investors expect prices to fluctuate in the range of +15 and -15 in the next thirty days. Theoretically, VIX oscillates between 15 and 35. Any value around or below 15 represents low volatility against values higher than 35, which indicate high fluctuations in the market.Possible VIX Value Range

VIX (CBOE Volatility Index) can theoretically reach any value from zero to positive infinite. It can not be negative, but there it no theoretical limit on the upside. VIX can definitely go over 100.According to the rule of 16, if the VIX is trading at 16, then the SPX is estimated to see average daily moves up or down of 1% (because 16/16 = 1). If the VIX is at 24, the daily moves might be around 1.5%, and at 32, the rule of 16 says the SPX might see 2% daily moves.

India VIX is a measurement of market volatility. Usually, when India VIX rises, NIFTY falls, indicating a good time to buy stocks. What is a poor India VIX value Since India VIX moves in a range of 15-35, any value above 35 signifies a condition of high volatility.

Is VIX at 30 good : The higher the VIX, the greater the level of fear and uncertainty in the market, with levels above 30 indicating tremendous uncertainty.

What if VIX is above 30 : VIX vs. S&P 500 Price

The price action of the S&P 500 and the VIX often shows inverse price action: when the S&P falls sharply, the VIX rises—and vice versa. As a rule of thumb, VIX values greater than 30 are generally linked to large volatility resulting from increased uncertainty, risk, and investors' fear.

Is 10% volatility high

Volatility averages around 15%, is often within a range of 10-20%, and rises and falls over time. More recently, volatility has risen off historical lows, but has not spiked outside of the normal range.

With stocks, it's a measure of how much its price changes in a given period of time. When a stock that normally trades in a 1% range of its price on a daily basis suddenly trades 2-3% of its price, it's considered to be experiencing “high volatility.”Understanding how the VIX index is calculated can help investors gauge market sentiment based on its price. The price of VIX can guide your decision making on when to buy or sell securities. As a general rule, when the price of VIX is: $0-15, this usually indicates optimism in the market and very low volatility.

Can volatility be above 1 : Volatility can theoretically reach any value from zero to positive infinite. This means that it can be greater than 1%.