Antwort Why not to invest in REITs? Weitere Antworten – Is there a downside to investing in REITs

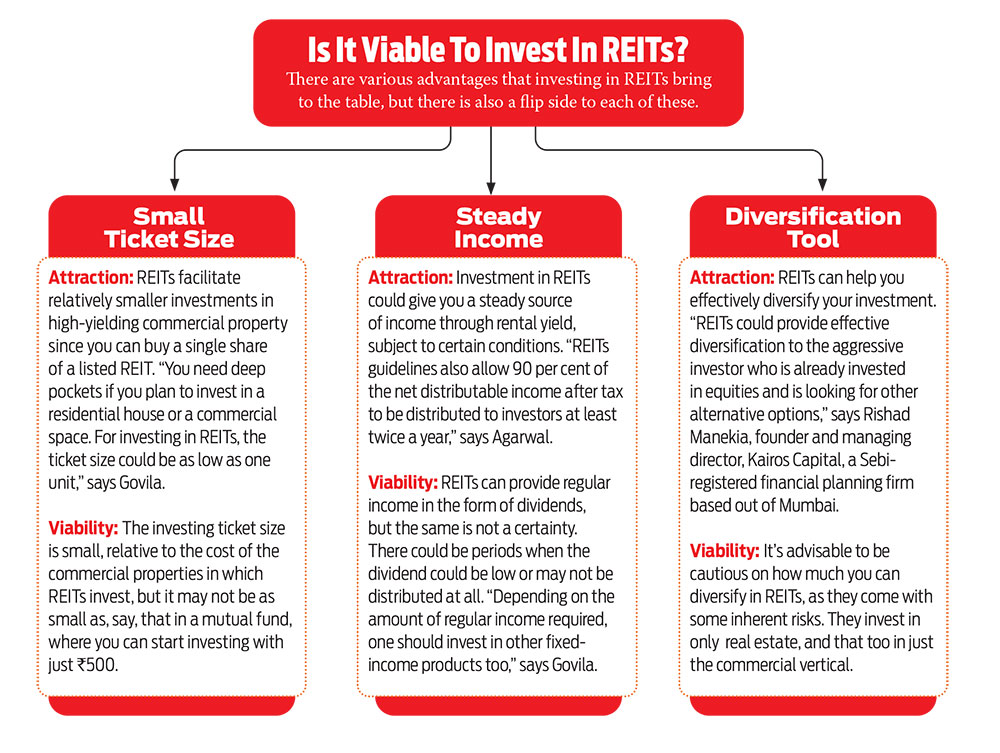

Non-traded REITs have little liquidity, meaning it's difficult for investors to sell them. Publicly traded REITs have the risk of losing value as interest rates rise, which typically sends investment capital into bonds.Some of the main risk factors associated with REITs include leverage risk, liquidity risk, and market risk.Because of their lower volatility, REIT returns are less correlated with the stock market. That makes REITs an excellent way for investors to build a diversified portfolio and improve their risk and return profile.

Is it good to buy REITs now : Bottom line. Investors eyeing REITs may find a potential recovery ahead. With rate cuts on the horizon, many publicly traded REITs have rebounded, and the industry as a whole seems well-poised for a recovery in the coming year.

What I wish I knew before buying REITs

A lot of REIT investors focus too way much on the dividend yield. They think that a high dividend yield implies that a REIT is cheap and a good investment opportunity. In reality, it is often the opposite, and the dividend does not say much, if anything, about the valuation of a REIT.

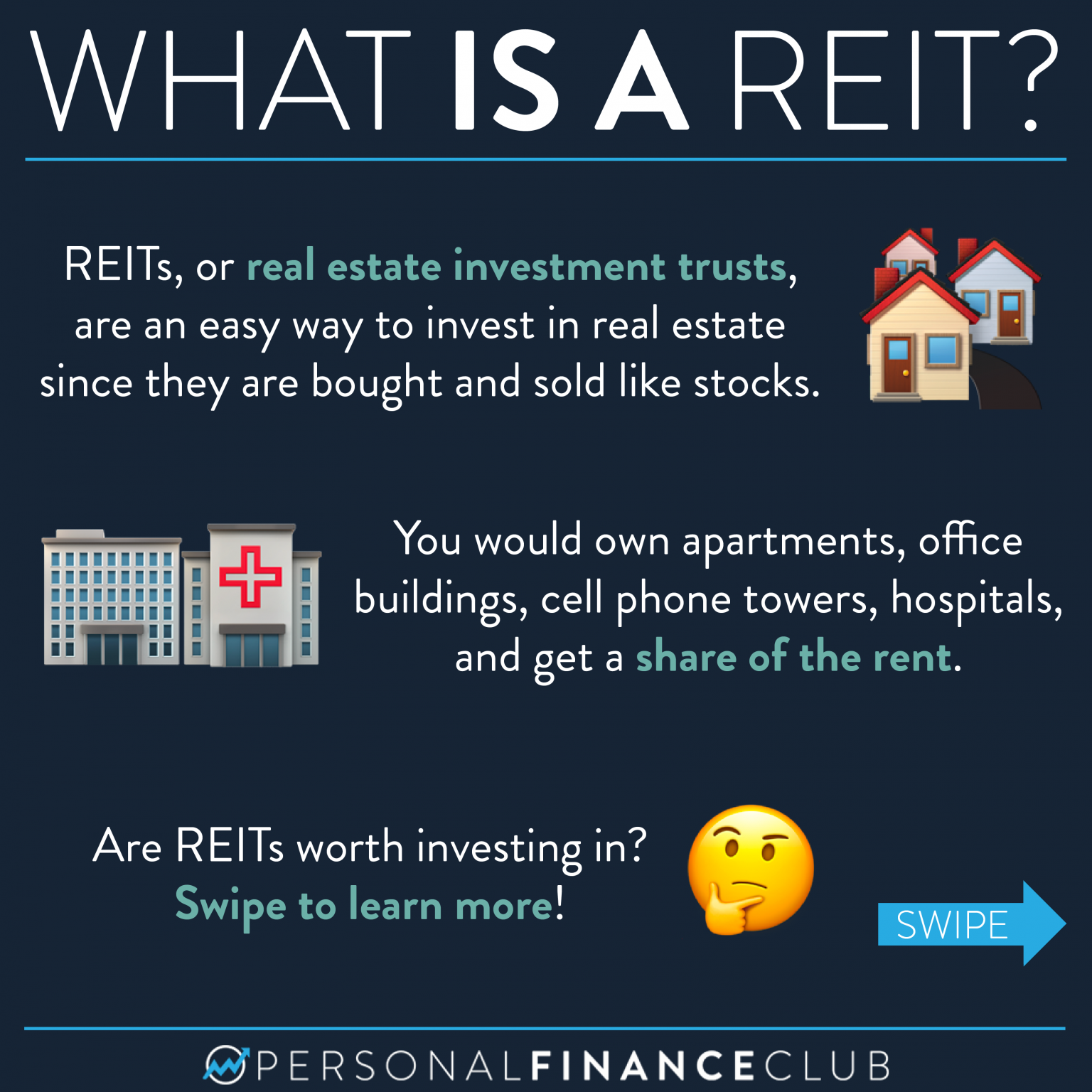

Are REITs a good investment in 2024 : April 2, 2024, at 2:50 p.m. Real estate investment trusts, or REITs, are a great way to invest in the real estate sector while diversifying your options. Real estate investments can be an excellent way to earn returns, generate cash flow, hedge against inflation and diversify an investment portfolio.

Stocks and REITs are not guaranteed and have been more volatile than bonds. Stocks provide ownership in corporations that intend to provide growth and/or current income. REITs typically provide high dividends plus the potential for moderate, long-term capital appreciation.

Over the long term, our research found that REITs have outperformed stocks. Since 1994, three REIT subgroups stood out for their ability to beat the S&P 500. Here's a closer look at these market-beating REIT types.

Will REIT bounce back

In fact, REIT total returns bounced back with impressive performance in the last quarter of 2023. Based on historical experience, the convergence of the wide valuation gap between public and private real estate will likely ensure continued REIT outperformance into 2024.But despite that, most REITs have kept growing their dividend. Most of them hiked in 2022, 2023, and will hike again in 2024. This is the ultimate proof that REITs are doing better than what the market appears to believe.How to Qualify as a REIT To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

REITs' average return

Return a minimum of 90% of taxable income in the form of shareholder dividends each year.

Is REIT good for long term : Are REITs Good Investments Investing in REITs is a great way to diversify your portfolio outside of traditional stocks and bonds and can be attractive for their strong dividends and long-term capital appreciation.

How often do REITs go out of business : Bankruptcies are extremely rare in the REIT sector. After all, REITs are required to keep the bulk of their assets in physical properties, or debt backed by real estate. Most real estate tends to appreciate over time, and as long as it holds its value, a REIT can sell properties to pay down debt in a pinch.

Can a REIT go out of business

REIT bankruptcies have indeed been a rarity since the REIT debacle of the mid-1970s, when high leverage and highly speculative real estate investments resulted in numerous REIT failures. Thereafter, REIT managers became far more conservative in their investment and financing practices.

With healthy property fundamentals and a favorable interest rate environment, REIT fund managers expect the sector to deliver double digit returns this year.What this means is that REITs are ideal borrowers for banks. They are exactly who they want to do business with because they know that the risk of a REIT bankruptcy is extremely low. Just look at the past. There have been very few REIT bankruptcies over the past 50+ years.

How long should I hold a REIT : "Both public and non-public REIT investments should be considered long-term, and that could mean different things to different folks, but in general, investors who typically invest in REITs look to hold them for a minimum of three years, and some of them could hold them for 10+ years," Jhangiani explained.